Table of Content

The EMIs will proportionately increase with every partial disbursement made as per the progress of construction. You can apply for housing loans at any time once you have decided to purchase or construct a property, even if you have not selected the property or the construction has not commenced. You can even apply for a home loan whilst you are working abroad, to plan for your return to India in future.

Repo is the rate at which Reserve Bank of India lends funds to commercial banks when needed. This is the third hike since the beginning of the current financial year, taking the rate is back to pre-pandemic levels in order to tame the inflationary pressure. IFC, a member of the World Bank Group, has extended a $400-million loan to India's largest mortgage lender, HDFC, to boost green housing in the affordable segment. IFC's funding will help HDFC especially focus on its green affordable housing portfolio, with 75% or $300 million of the proceeds earmarked for this sector. The non-banking finance company’s best rates are available only for applicants with credit score of 800 and above.

Can I get an approval for a home loan while I decide which property, I should purchase?

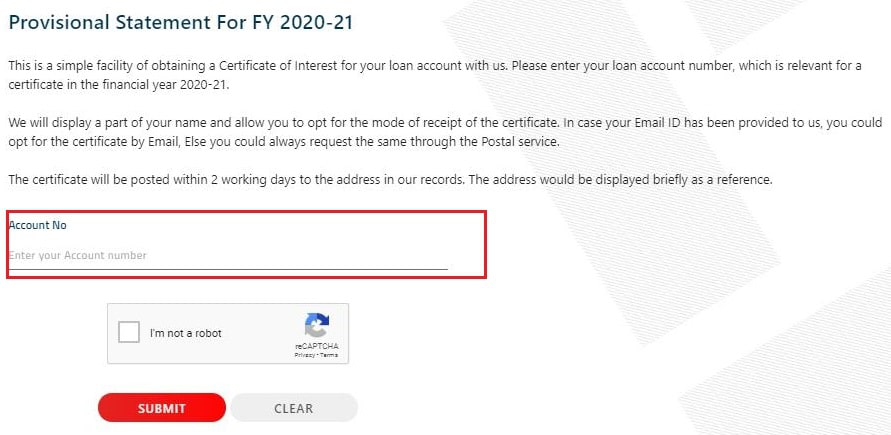

It is provided to you by HDFC and is required for claiming tax deductions. If you are an existing customer, you can easily download your provisional home loan provisional certificate from our online portal . Post the fixed rate tenure, the loan switches to an adjustable rate. However, the approval of your loan depends on your repayment capacity.

This option provides you the flexibility to increase the EMIs every year in proportion to the increase in your income which will result in you repaying the loan much faster. Working Capital, Debt Consolidation, Repayment of Business Loan, Expansion of business, Acquisition of Business asset or any similar end usage of funds. The maximum period of repayment of a loan shall be up to 30 years for the Telescopic Repayment Option under the Adjustable Rate Home Loan. For all other Home Loan products, the maximum repayment period shall be up to 20 years. Ensure that the documentation of your home loan application is in order as per the requirement of the lender.

Apply online for a HDFC Home Loan

Housing.com shall not be liable in any manner for any losses, injury or damage suffered by such person as a result of anyone applying the information in these articles or making any investment decision on the basis of such information , or otherwise. The users should exercise due caution and/or seek independent advice before they make any decision or take any action on the basis of such information or other contents. Ensure that you submit all the required documents as needed by the lender for loan processing. HDFC disburses loans for under construction properties in installments based on the progress of construction. Every installment disbursed is known as a 'part' or a 'subsequent' disbursement.

It is estimated that 275 million people in the country, or 22% of the over 1.4 billion population, do not have access to adequate housing, and rural housing shortage is twice that of urban areas. It is estimated that 275 million people in the country or 22 per cent of the over 1.4 billion population do not have access to adequate housing, and rural housing shortage is twice that of urban areas. As of 2018, the urban housing shortage was 29 million units, increasing by over 54 per cent since 2012. The move by India’s largest NBFC follows a 35-basis point increase in the repo rate by the Reserve Bank of India on December 7, 2022.

HDFC Home loan prepayment: Pointers to keep in mind

The RBI will be compelled to employ the interest rate hike option, in addition to other measures to control inflation, till inflation falls below its comfort level. Analysts said the gap would start to narrow going into the next year. Going forward, they expect a combination of factors, including the RBI’s rate hikes, slowing GDP growth, and the normalisation of the base effect, to blunt the sharp growth in credit. Credit growth has moderated from around 18 per cent in early October. Deposit growth is picking up gradually as banks have begun to pass on the rate hikes done by the RBI. As the system liquidity is shrinking, banks have become more aggressive to garner deposits to fund the high credit growth in the economy.

Borrowers with a credit score below this cutoff will have to pay anywhere between 8.95% and 9.30% interest on home loans. Go through the list of documents required and keep them ready before starting your home loan application process. HDFC Ltd offers low home loan interest rates starting from 8.20 per cent per annum, the statement said. For those who do not have the required credit score, the interest rate may vary between 8.40 per cent to 8.90 per cent. HDFC said it has earmarked 75%, or $300 million, of the IFC funding for financing green affordable housing units.

We are unable to show you any offers currently as your current EMIs amount is very high. You can go back and modify your inputs if you wish to recalculate your eligibility. Incidental charges & expenses are levied to cover the costs, charges, expenses and other monies that may have been expended in connection with recovery of dues from a defaulting customer. A copy of the policy can be obtained by customers from the concerned branch on request. Passport size photograph of all the applicants / co-applicants to be affixed on the Application form and signed across.

The reset can be according to the financial calendar, or they can be unique to each customer, depending on the first date of disbursement. HDFC may at its sole discretion, at any point during the subsistence of the loan agreement, alter the interest rate reset cycle on a prospective basis. The documentation needed to be submitted along with your home loan application form is available here. This link provides a detailed checklist of KYC, Income and property related documents required for the processing of your home loan application. The checklist is indicative and additional documents could be asked for during the home loan sanction process. “This rate of interest is applicable to home loans, balance transfer loans, house renovation, and home extension loans.

You may be eligible for tax benefits on repayment of the principal and interest components of your Home Loan as per sections 80C, 24 and 80EEA of the Income Tax Act, 1961. Since the benefits may vary each year, please do consult your chartered accountant/ tax expert for the latest information. Home loan providers usually charge a processing fee around 0.5% of the loan amount to be availed. Choose a home loan provider who is transparent w.r.t. processing fee and other related charges. With this option you get a longer repayment tenure of up to 30 years.

You will be taken to the loan application form where the details you have already provided will be prefilled. Fill in the balance details – your date of birth and password and click on ‘Submit’. For your convenience, HDFC offers various modes for repayment of your house loan.

HDFC offers an adjustable-rate loan also known as a floating rate loan as well as a trufixed loan in which the interest rate on the home loan remains fixed for a specific tenure after which it converts into an adjustable-rate loan,” it said. Several banks and lenders have revised their lending rates after the Reserve Bank of India hiked its benchmark lending rates on December 7. The RBI Monetary Policy Committee led by Governor Shaktikanta Das hiked Repo Rate by 35 basis points to 6.25 percent on December 7.

The RBI raised the repo rate by 0.35 percent earlier this month, from 5.9 percent to 6.25 percent. If the home loan is being prepaid after 36 months, no charges will be levied. The following rules will apply to borrowers who are not individuals (i.e., businesses, sole proprietorship firms or HUFs acting as co-applicants). You may easily prepay HDFC home loan online by using the customer portal. I declare that the information I have provided is accurate & complete to the best of my knowledge. I hereby authorize HDFC Ltd. and its affilliates to call, email, send a text throught the Short Messaging Service and/or whatsapp me in relation to any of their products.The consent herein shall override any registration for DNC/NDNC.

You may issue standing instructions to your banker to pay the installments through ECS , opt for direct deduction of monthly installments by your employer or issue post-dated cheques from your salary account. Repayment of home loans is done through Equated Monthly Installments , which is a combination of interest and principal. In the case of loans for resale homes, EMI begins from the month subsequent to the month in which disbursement of the loan is done. In the case of loans for under-construction properties, EMI usually begins once the construction is complete and the house loan is fully disbursed.

No comments:

Post a Comment